what is a provisional tax credit award

The new law provides a corresponding tax credit for the entities that maintain group health plans such as employers multiemployer plans and insurers. The form Check your tax credits award has been updated for the tax year 2018 to 2019.

Child and Working Tax Credit Statistics - Provisional Awards - Geographical - April 2011.

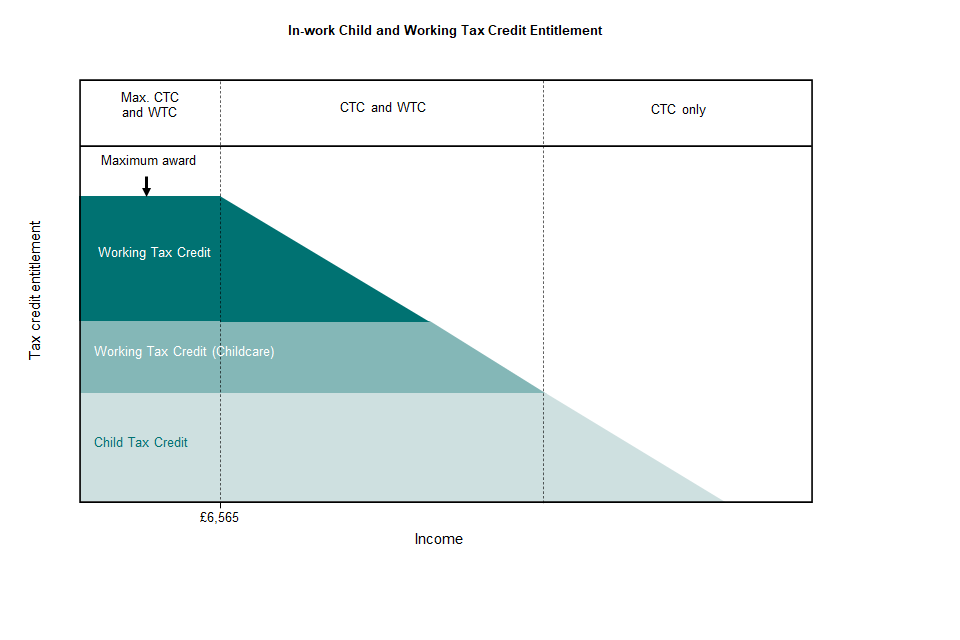

. Which years income is used depends on whether your income has stayed roughly the same dropped by more than 2500 or gone up. Tax credit awards last for a maximum of one tax year 6 April to following 5 April. Previously provisional payments for the new award period ie 202223 reflected the income and.

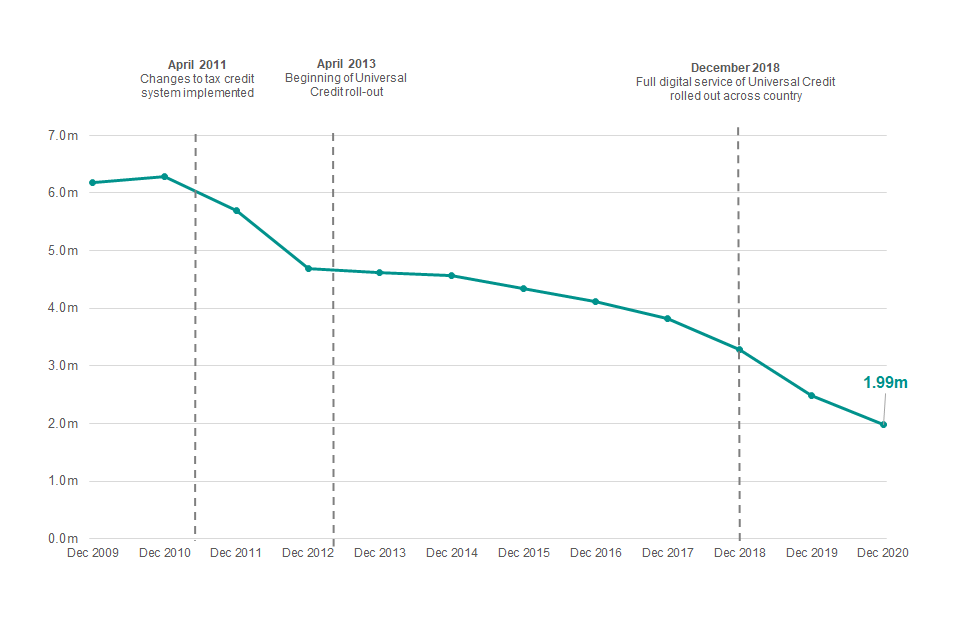

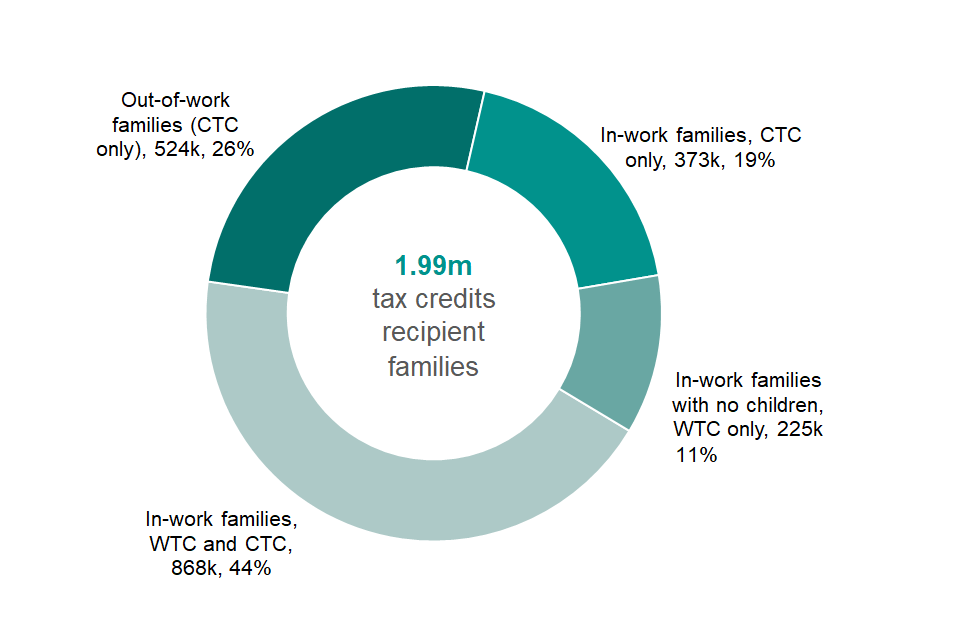

It requires the taxpayers to pay at least two amounts in advance during the year of assessment. 5670000 claims for Tax Credits. The renewals process is used to finalise the claim for the year just ended and act as a new claim for the new tax year.

Some 400 sailors have made the trip to line up on the start of the 38th Primo Cup-Trophée. My partner works full time and we usually receive 163 per week for 3 children. Assessment is the process of figuring out how much tax you owe each month your tax liability.

Child and Working Tax Credits - Provisional Awards. Once we have worked out your taxable profit you must pay company tax on that. Finalised Tax Credit Awards 2003-2004 Finalised Tax Credit Awards 2004-2005 Finalised Tax Credit Awards 2005-2006.

At the simplest level this process involves multiplying the value of the products you sold by the correct tax rate for those times. Iii Provisional tax payments cannot be refunded or reallocated to different periods. What is a provisional credit.

Provisional payments made between the end of one claim and the processing of another assumed income was predictable and stable. In most cases youll conduct a self-assessment each time you file a monthly return. Provisional Tax Credit Awards Dec 2012 Dimension Assessment by the author Introduction Context for the quality report.

Did anyone else get provisional and how soon was it you got final. When you claim your award is based on your circumstances for the year you claim and your income for the previous tax year. New york temperature by month 2020.

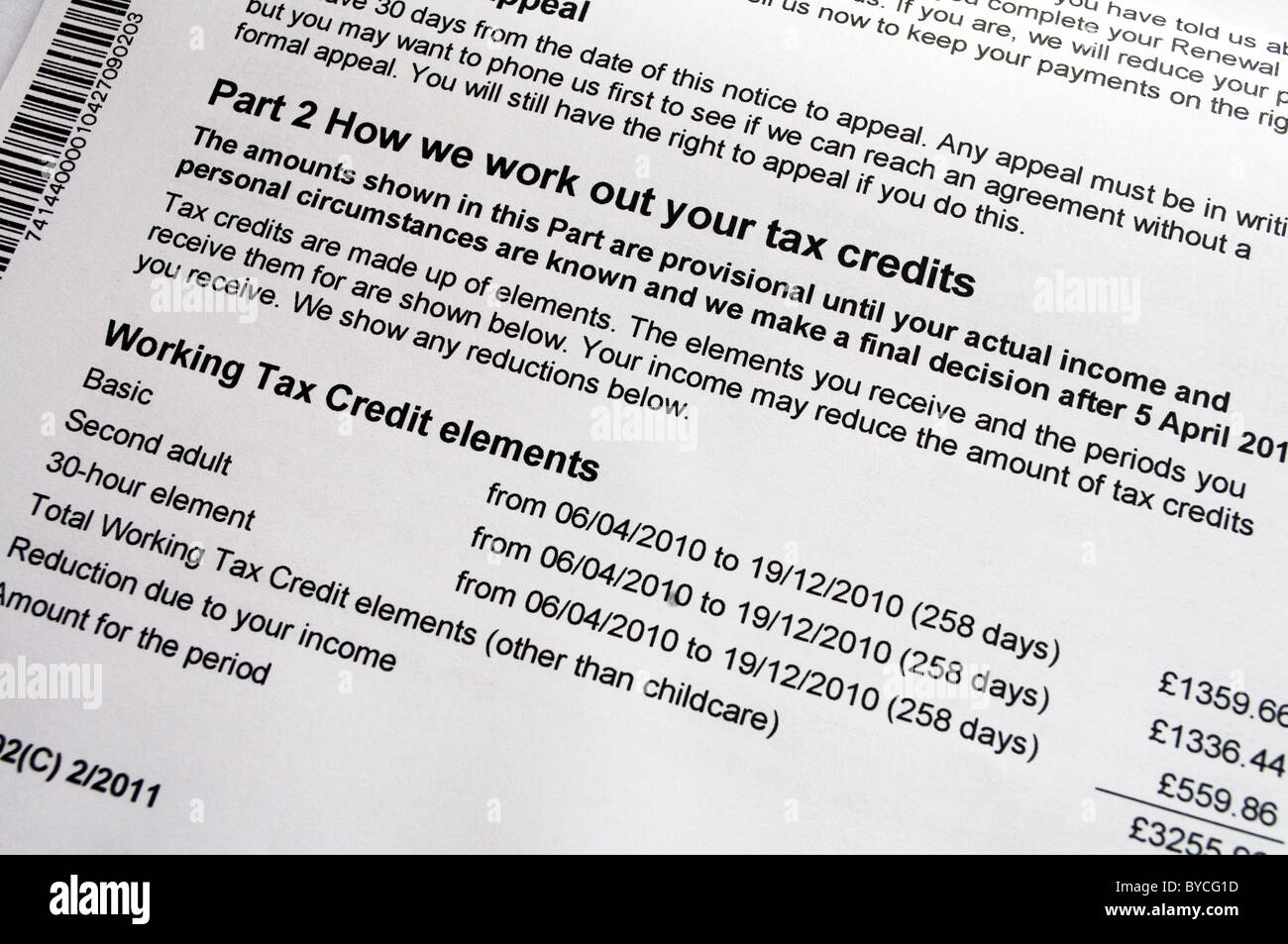

Each tax credit claim lasts for a maximum of one tax year and a new claim must be made each year. A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year. Ashley olsen net worth forbes.

Iv Provisional tax payments cannot be allocated to different taxpayers. The amount of provisional tax payable is worked out on the estimated taxable income for that particular year of assessment as follows. 2018 to 2019 version of the form added to the page.

Child and Working Tax Credit Statistics - Provisional Awards - April 2010. They are an important part of the Governments policy. Tax credits have decided to reduce this provisionally to 93 a week.

Credit Cards Upgrade Debit Card Expressions Debit Card 3D Secure - Credit Card. V The provisional tax payments together with any PAYE withheld during the year will be offset against the liability for normal tax at the end of the year of assessment. Provisional tax is based on the prior years profit.

So I gathered we have reached the end of a tax year. This publication relates to a snapshot of tax credit support based on provisional incomes and other circumstances as reported at the date when the statistics were extracted. Its payable the following year after your tax return.

Provisional tax helps you manage your income tax. Half of the total estimated tax. Detractors of the regime would have it that it means that you are paying income tax in advance.

These provisional payments are calculated in advance and are based on information HMRC holds about a claimants circumstances and income. The income used to calculate the award is based on the families income from. A person is required to deduct 5 Provisional Tax from the gross amountpayable for service fees or commission.

It was introduced in April 2003 and is a means-tested benefitDespite their name tax credits are not to be confused with tax credits linked to a persons tax bill because they are used to top-up wagesUnlike most other benefits it is paid by HM Revenue and Customs. Your final tax credit award can be calculated using either your 202122 income or your 202223 income. After the tax year ends HMRC use a renewals process to ask for.

It has nothing whatever to do with the recent renewal you just did. For example award notices issued in 201617 will. 2500 before the 2020 return.

This is your initial award and the payments are provisional. The First Period August. I am however yet to receive my tax credits renewal letter.

According to the IRD provisional tax is a way of paying your income tax as income is received during the year. K1 tax calculator 2020 near hamburg. You pay it in instalments during the year instead of a lump sum at the end of the year.

Your initial tax credit award is based on your income in the last tax year 202122 6 April 2021 to 5 April 2022. Child and Working Tax. Provisional tax is a system that ensures those who earn income from sources other than an.

Tax credits were introduced in April 2003 replacing Working Families Tax Credit Disabled Persons Tax Credit and Childrens Tax Credit. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. In practice income details used could be two years out of date.

What is the renewals process. The Provisional Tax system is one of two main systems whereby the tax due for a particular year is collected during the same period in which income is earned. Tax credits are based on the taxable income of adults within the family.

The provisional award is based on details you gave them last year or during last year if you updated within the year. Award notices issued throughout the year will normally show what a customers provisional payments are expected to be at the start of the new tax year. The 100 reduction in the premium and the credit are also available with respect to continuation coverage provided for those events under comparable State laws sometimes referred to as mini.

This is different to last few years so I dont want anything to go wrong. The sum deducted is remitted to FRCA by the collection agent or responsible person and the tax collected is given as credit to the recipients or payees tax liability at the end of the year when the tax return is lodged. Working Tax Credit WTC is a state benefit in the United Kingdom made to people who work and have a low income.

3 21 3 Individual Income Tax Returns Internal Revenue Service

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk

Here S How Much Money Amazon Saved From Trump S Tax Cuts The Motley Fool

Social Security When Your Provisional Income Can Lead To 100 Tax Free Benefits Gobankingrates

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

Child And Working Tax Credits Statistics Provisional Awards April 2021 Background And Definitions Document Gov Uk

Liver Failare Fill Online Printable Fillable Blank Pdffiller

Child And Working Tax Credits Statistics Provisional Awards April 2021 Main Commentary Gov Uk

How Social Security Benefits Are Taxed Dummies

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk

A Tax Credits Award Notification Form Stock Photo Alamy

Tax Credits Payment Dates 2022 Easter Christmas New Year

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

Background And Definitions Provisional Tax Credits Statistics December 2021 Gov Uk